Johnson & Johnson

Topical Anti-fungal

Background

Johnson & Johnson engaged Plexus Ventures to discuss the potential divestment of a number of mature brands in Europe, as part of its routine review of its portfolio to identify non-strategic assets. After internal reviews with the local country managers, J&J selected a package of well-known, high margin OTC anti-fungal brands: Pevaryl®, Epi-Pevaryl®, Gyno-Pevaryl® and Fungoral®. These products utilize the anti-fungal substances econazole and ketoconazole and are used to treat common fungal infections. At the time, revenues were centered principally in Sweden and Germany, followed by Portugal, Switzerland, France, Greece and Norway.

Objective

In January, 2017, J&J appointed Plexus Ventures to monetize the portfolio of OTC anti-fungal brands. The seller had a dual focus: value maximization and speed to closing. The objective was to seek a buyer who could close this transaction in just five months. Those unable to maintain pace would be dropped from the process.

Process

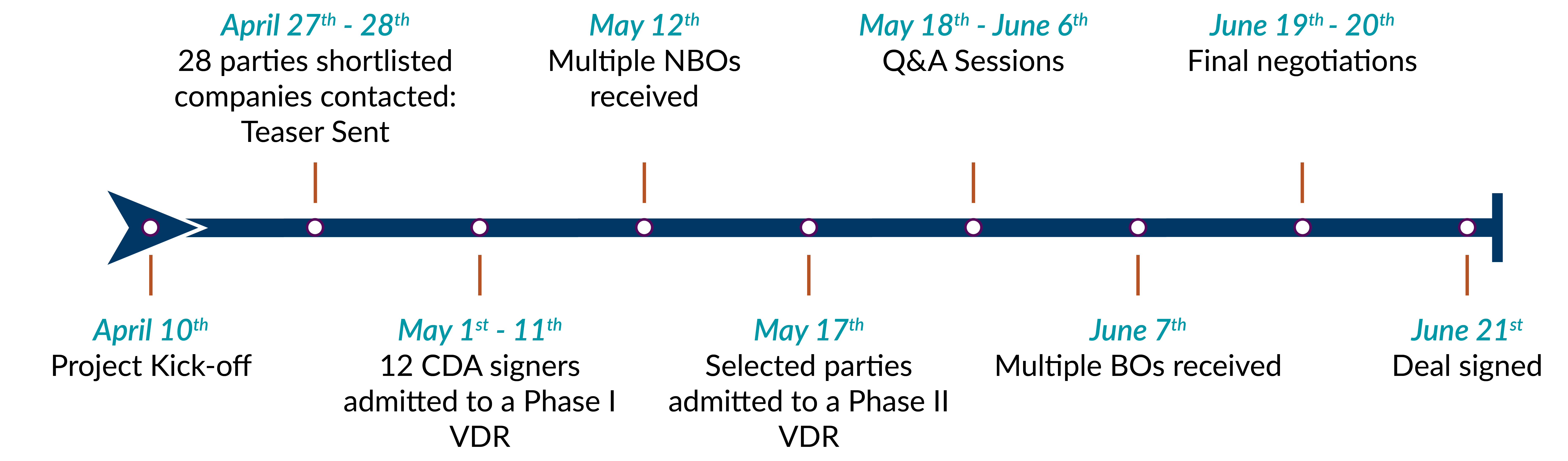

On April 27, the Plexus team kicked off a contact program having 28 targets — a limited number of companies with a strong rationale for interest and the capabilities to move fast. The process was designed and tailored to meet the need for an expedited timeline. Upon executing a CDA, parties were admitted to a Phase I data room with sufficient information to submit a Non-Binding Offer by May 12. Qualifying bidders were admitted into a Phase II data room. No formal management presentations were conducted; however, bidders were permitted to submit questions to J&J and to participate in a Q&A session with management. Binding Offers were submitted the first week in June. Negotiations were conducted on June 19 and 20 and the transaction was signed the latter day. The transaction closed on June 21.

Outcome

Trimb Healthcare AB, a rapidly growing Swedish OTC and consumer healthcare company backed by the private equity fund, Avista Capital Partners, acquired the J&J portfolio of products. Through this acquisition, Trimb strengthened its OTC position in northern Europe and also its presence in dermatology, realizing synergies with its other anti-fungal brands, such as Cortimyk®and Nailner®. Two years later, Karo Pharma acquired Trimb Healthcare.