Novartis Habitrol®

Nicotine Patch

Background

In April, 2014, Novartis and GSK announced a major 3-part inter-conditional transaction involving their Consumer Healthcare, Vaccines and Oncology businesses. GSK and Novartis both marketed nicotine replacement products in the United States. GSK’s Nicorette® and Nicoderm® CQ brands combined to hold a commanding position in the U.S. retail market for smoking cessation products with the Novartis Habitrol® brand a prominent competitor.

On November 26, 2014, the Federal Trade Commission (“FTC”) issued a proposed consent order under which Novartis Consumer Health agreed to divest its Habitrol® nicotine replacement therapy transdermal patch as a pre-requisite to the larger Novartis-GSK deal.

Objective

For the transaction to conclude, the FTC mandated Novartis to dispose of Habitrol® to avoid a reduction in competition within the category in the US market. To meet FTC requirements, an acquiring company would need to have similar commercial capabilities as the divesting company to preserve market competition. To avoid delays in closing the larger transaction, Novartis desired the quickest possible resolution of the FTC mandate.

Process

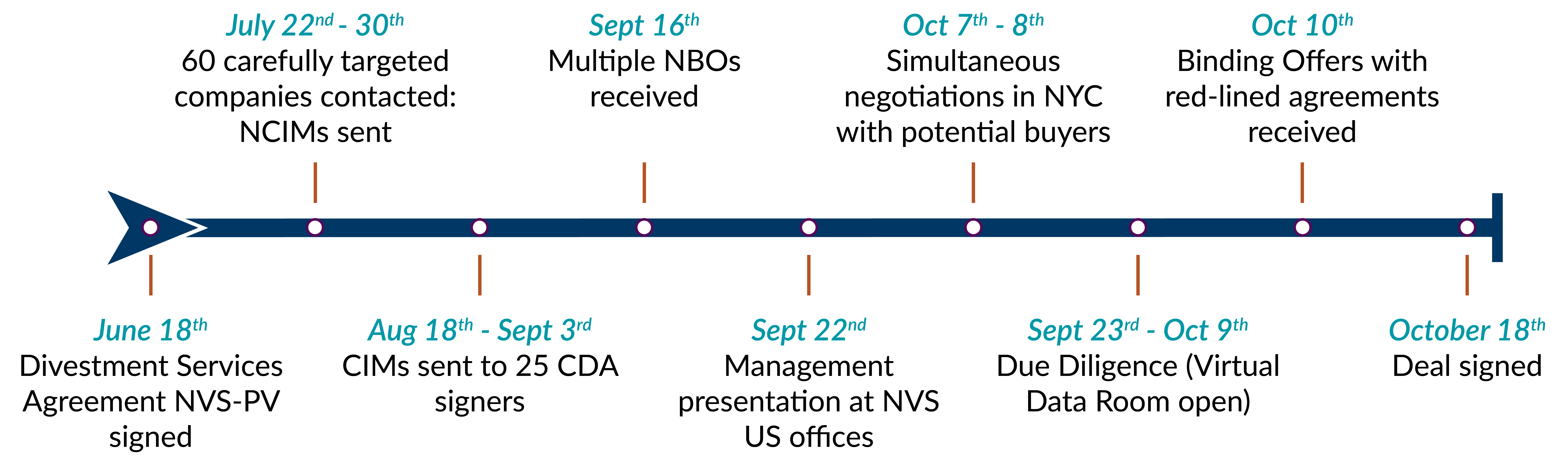

Novartis selected Plexus Ventures to manage the divestment process due to our vast experience in consumer health transactions and our ability to devote singular attention to the project. Throughout the process, Plexus worked with Corporate M&A and Consumer Health management teams and with internal, external and FTC specialist legal counsels. Progressing along an expedited timeline was a critical factor in this process.

Outcome

• Ultimately Novartis selected Dr. Reddy’s as the purchaser of the Habitrol® business in the United States. The acquisition fit with Dr. Reddy’s strategic objective to grow its U.S. consumer healthcare business.

• The time from Plexus engagement to transaction signing took just 4 months, with final closing, after FTC approval, coming two months later.

• The Novartis-Dr. Reddy’s Habitrol® deal enabled the Novartis-GSK Transaction to proceed on schedule.