YouMedical

Medical Devices/OTCs

Background

Karmijn Kapitaal, founded in 2010 by three women entrepreneurs, provides growth capital and finances buyouts of small and mid-sized Dutch enterprises which are led by balanced teams of men and women. Karmijn is the only fund of its kind in Europe.

Karmijn approached Plexus in April, 2015 noting interest had surfaced from third parties about acquiring one of its portfolio companies. YouMedical had a highly motivated Founder and CEO, a capable management team, 20 employees, €15 million in revenues — comprised of innovated medical devices and OTC products sold in numerous markets — solid profitability, out-sourced production, and well-developed financial and manufacturing software. The primary factor in the company’s success stemmed from its excellence in developing innovative products, making continuous improvements and meaningful line extensions, and rapidly developing and introducing new products into the market.

Objective

It seemed clear YouMedical could serve either as a turn-key operation for an interested acquirer or a solid bolt on business for an existing company seeking growth. Karmijn was hesitant as YouMedical’s General Manager had quit upon learning of the company’s potential sale and the Founder and CEO did not wish to remain with the business post-sale. It became of paramount importance to convince potential buyers the remaining executives could effectively manage the business post-sale.

Process

Karmijn and YouMedical selected Plexus Ventures as we were recommended to them by a successful OTC entrepreneur who knew us from prior dealings and who was aware of our divestment expertise.Karmijn and YouMedical selected Plexus Ventures as we were recommended to them by a successful OTC entrepreneur who knew us from prior dealings and who was aware of our divestment expertise.

Outcome

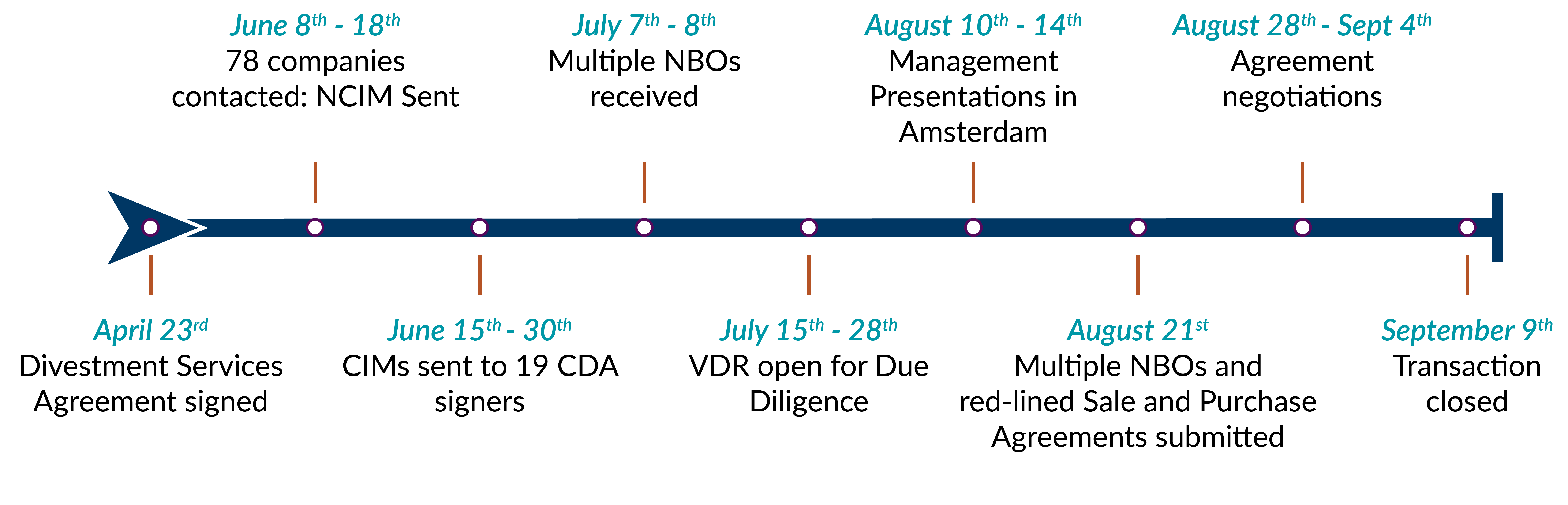

• From Plexus engagement to transaction closing took just four months.

• Swedish based Trimb Healthcare acquired YouMedical in a deal announced on August 31.

• The successful sale marked the first exit for Karrmijn Fund I.

• The sale allowed the founder/CEO to realize his dream of exiting his first company.

• Trimb Healthcare made a number of subsequent acquisitions and was later acquired.